Life Insurance in and around Greenville

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Taking care of those you love is an honor and a joy. You advise them on important decisions help them make decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

What are you waiting for?

Greenville Chooses Life Insurance From State Farm

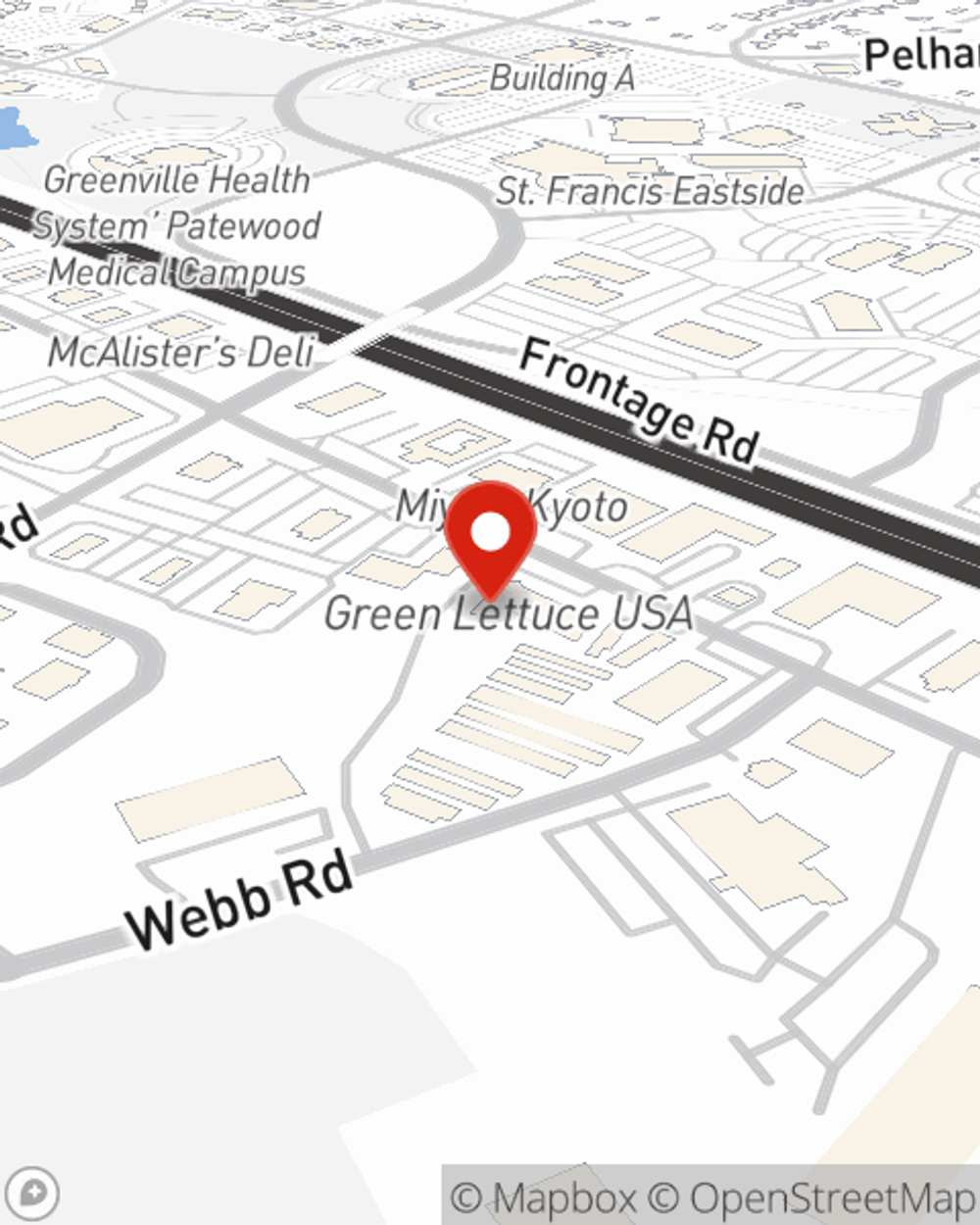

Fortunately, State Farm offers various policy choices that can be personalized to accommodate the needs of those most important to you and their unique situation. Agent Heath Satterfield has the personal attention and service you're looking for to help you purchase coverage which can support your loved ones in the wake of loss.

Interested in learning more about what State Farm can do for you? Visit agent Heath Satterfield today to get to know your individual Life insurance options.

Have More Questions About Life Insurance?

Call Heath at (864) 297-9178 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Heath Satterfield

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.